My 2025 Crypto Trends Report

Find the full Crypto Trends Report here: https://docsend.com/v/sfvqr/cryptotrends

I’m excited to publish the first annual edition of my Crypto Trends Report!

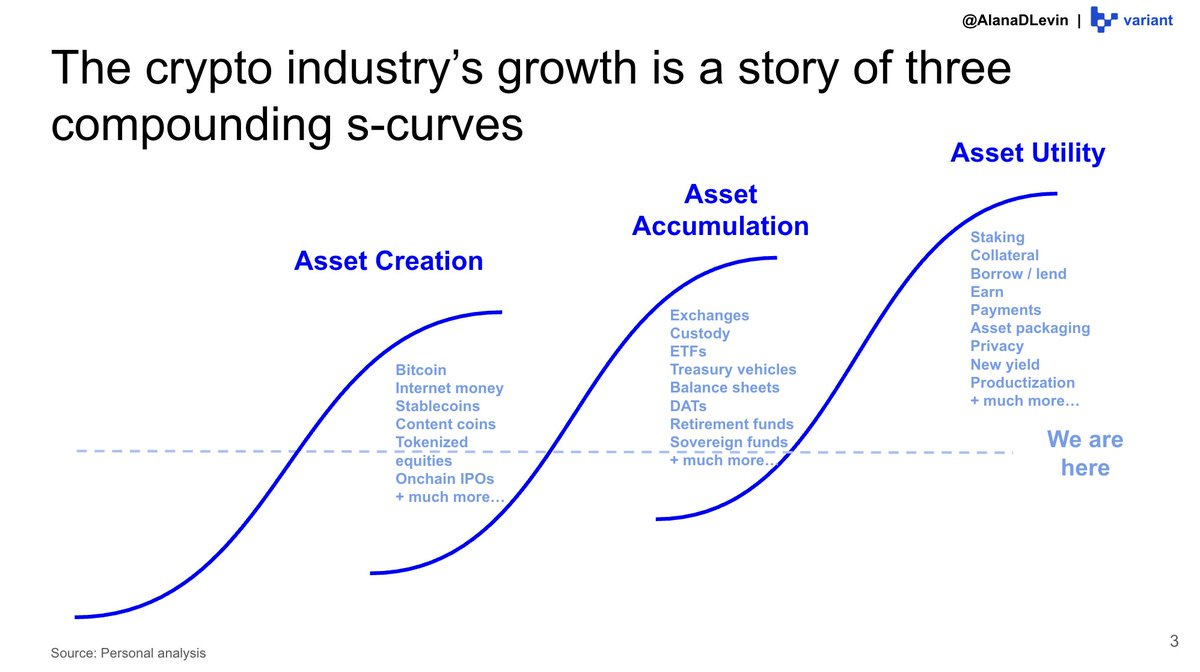

This report takes the perspective that the crypto industry’s growth can be viewed as a series of three compounding s-curves: asset creation, asset accumulation, and asset utilization.

Phase 1 is creation: the tokenization of value. The creation phase started with Bitcoin’s launch in 2009. Since then, it has grown to include layer-1 monetary assets, project tokens, stablecoins, content coins, memecoins, NFTs, tokenized equities, and more. From 2024-2025, the crypto industry moved up the steepest part of the s-curve. We went from ~20k listed, tradable tokens to millions in the course of just a few years. There is still significant room for innovation and growth (tokenized credit, onchain structured products, additional real-world assets, and much more), but the most dramatic zero-to-one moments have already occurred.

Phase 2 is accumulation: the more assets that exist – and the more valuable they become – the more that people want to hold those assets. This provides tailwinds for multiple sub-sectors within the industry: custody products, exchanges, and security solutions. Different custody solutions service different user groups: stablecoin-enabled apps may use embedded wallets like Turnkey, institutional investors often use qualified custodians, and active onchain users may use super-app-esque wallets like Phantom. The growing demand to buy, sell, and hold crypto assets also catalyzes increased distribution. Many incumbent exchanges (e.g. Coinbase) have seen volumes skyrocket. Traditional fintechs (e.g. Robinhood) have doubled down on crypto access, while newer venues (e.g. Axiom) have emerged with explosive growth. Asset managers are offering crypto access in retirement accounts, public companies are beginning to hold bitcoin and stablecoins on their balance sheets, and even some sovereign wealth funds are beginning to accumulate these assets. We have just begun to climb the steepest part of the s-curve.

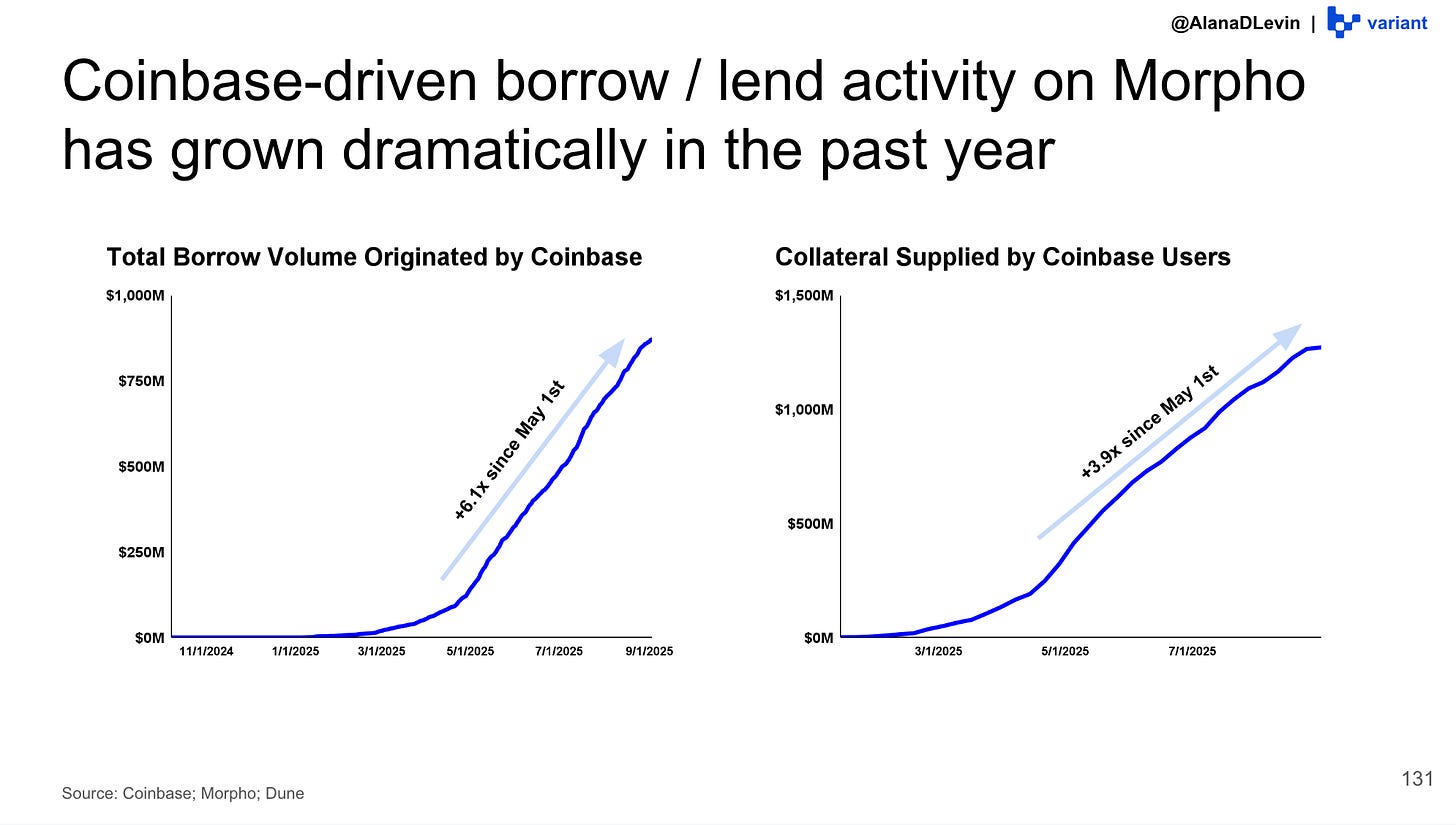

Phase 3 is utilization: putting assets to work. Once people hold assets, they want to start using them. Crypto assets are the most composable, accessible, and programmable financial assets that have ever existed. A number of exciting, robust use cases have begun to emerge: stablecoin payments, supplying & borrowing capital on lending protocols like Morpho, providing liquidity to onchain exchanges, and network staking. Yet we are still at the very early innings of the different ways in which tokenized assets can and will be used; we have barely begun to climb the s-curve. I see the design space for expanding and enabling greater asset utility as some of the largest and most exciting blue ocean opportunities over the coming years.

The deck is split into five broad categories: Macro, Stablecoins, Centralized Exchanges, Onchain Activity, and What’s Next. Each section loosely uses the framing of the three compounding s-curves to help contextualize the major trends and opportunities that exist in the crypto industry today.

I’d recommend reading the deck in full. But if you only have time for the highlight reel, here are some of the major trends we see in crypto today:

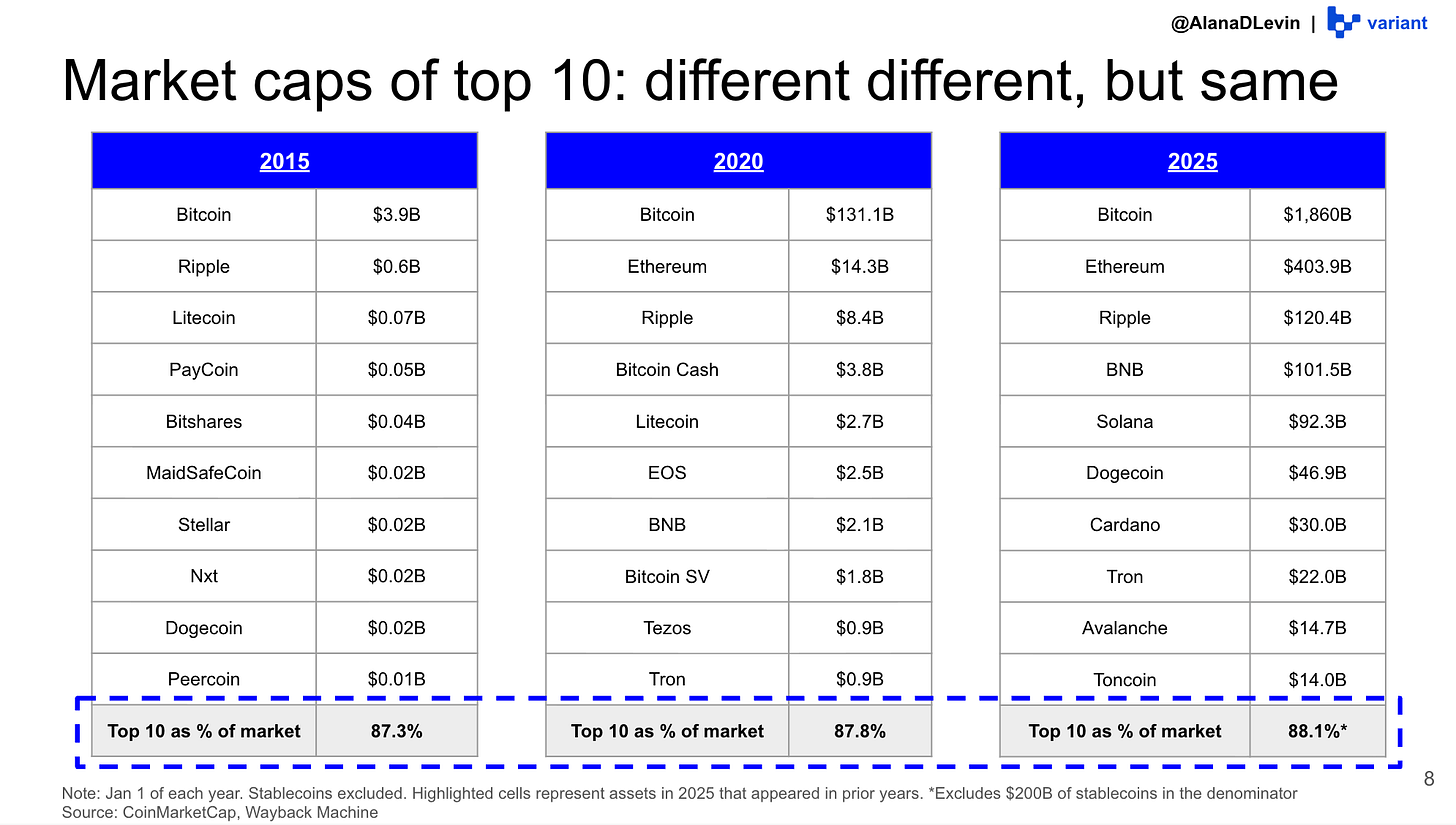

1. Macro. The major crypto assets keep getting bigger. Even as the total market cap of crypto has grown, the concentration of value among the top 10 crypto assets has remained shockingly consistent. It has also been challenging for new assets to enter the top five. There is real Lindy-ness and mimetic power to many of the top assets.

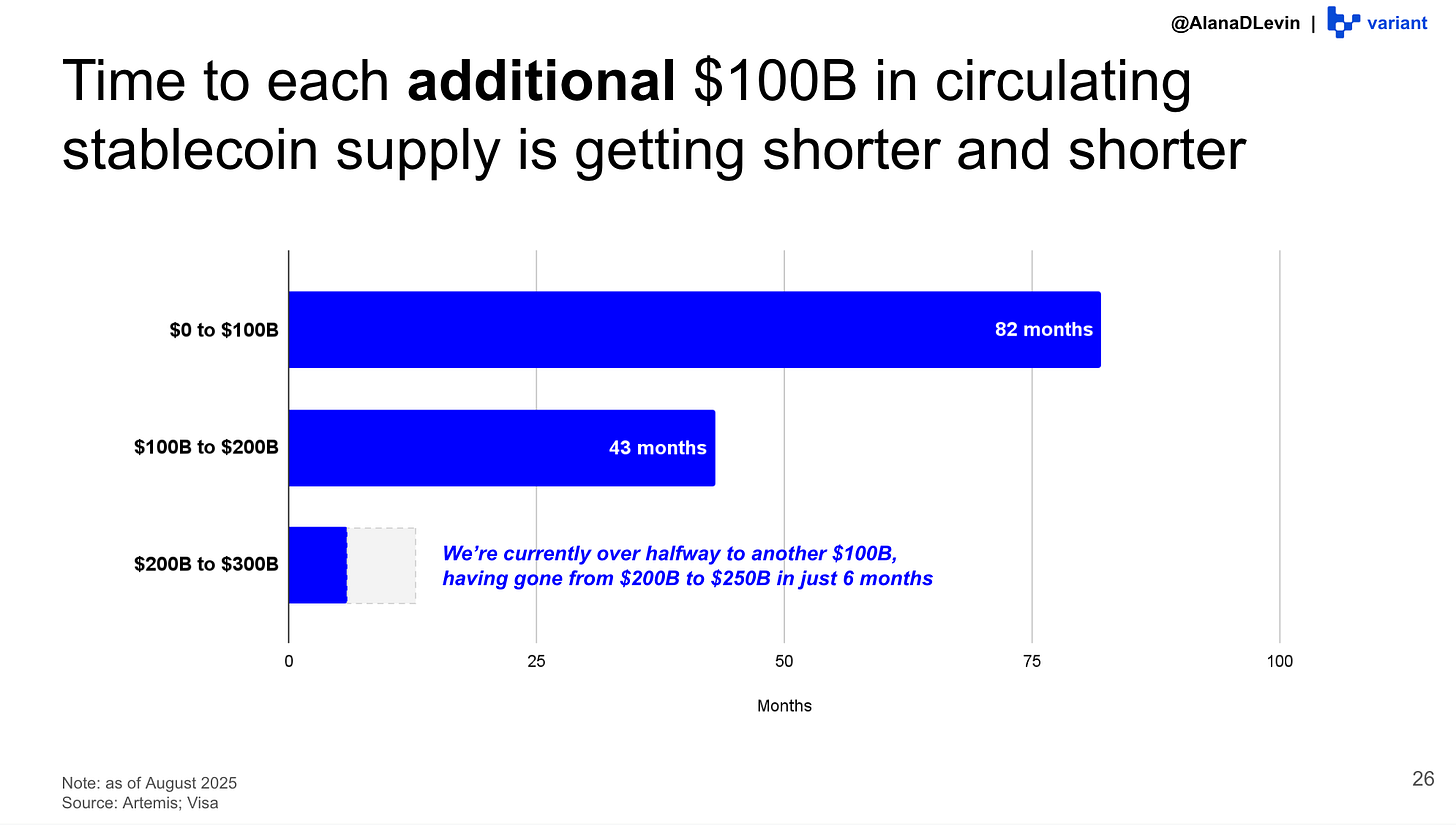

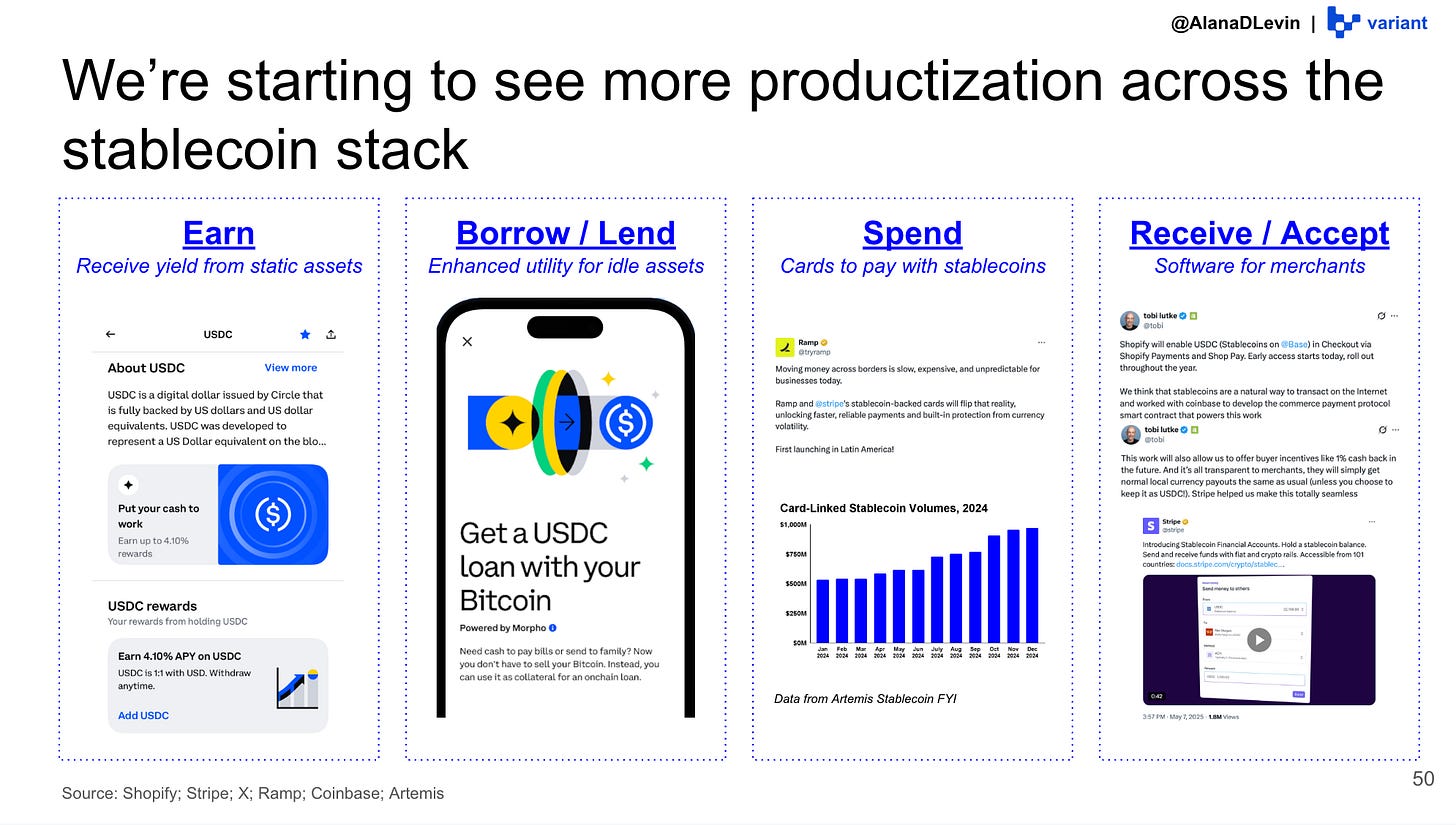

2. Stablecoins. Stablecoins have experienced explosive growth, across all three s-curves: new issuance (asset creation) is occurring at record pace, there are many new venues for on-ramping (accumulation), and we see an increasing number of ways to put stablecoins to work (utility). There are strong network effects within the category: the more stablecoins in circulation, the more useful they become. Similarly, the more entities that hold stablecoins, the greater one’s ability to build products and services around those assets. Several areas that have benefited to date from stablecoin productization are payments, earn products (e.g. lending protocols), and exchanges. Yet we believe there is still significant room for innovation across all three s-curves.

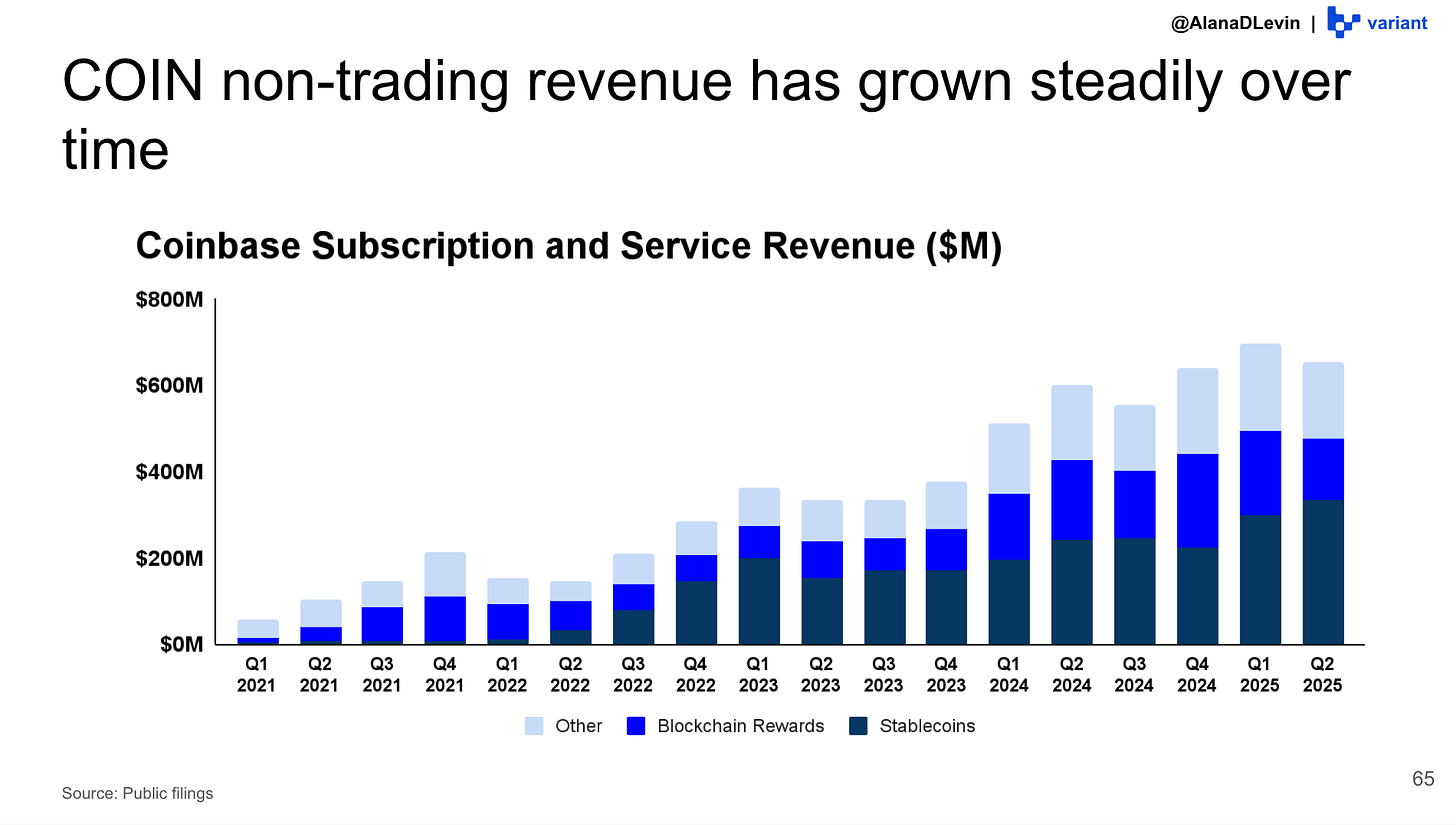

3. Centralized Exchanges: Centralized exchanges are some of the clearest winners from the “accumulation” s-curve. Both volumes and revenue have grown dramatically over the past five years. And notably, a second-order effect of the growth in trading is that users then hold those assets on exchanges – enabling exchanges to offer an expanded set of utility (e.g. staking, yield, and lending products). Many of the new ways to utilize crypto assets will end up getting built directly onchain, but may find strong distribution through centralized exchange integrations.

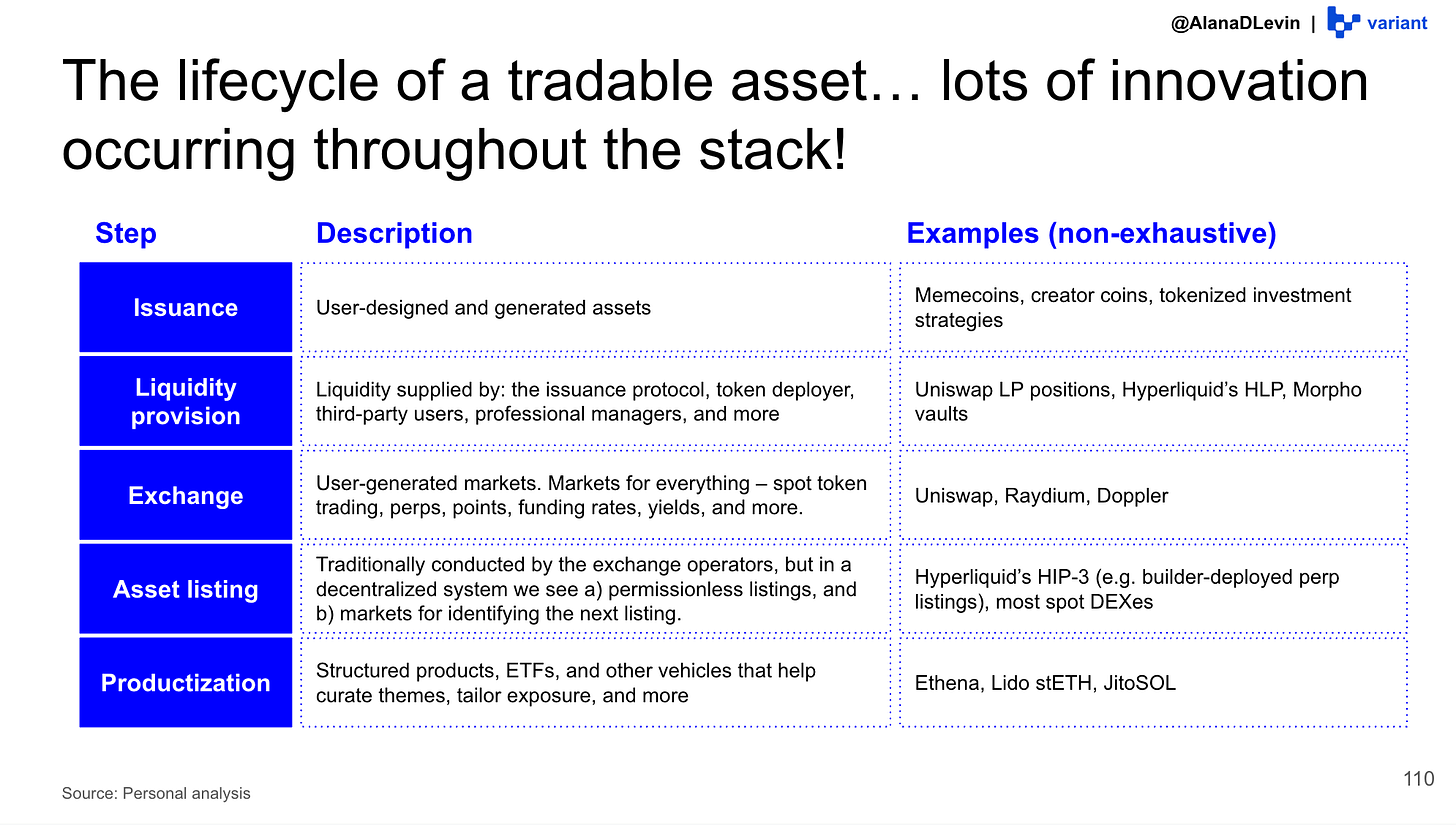

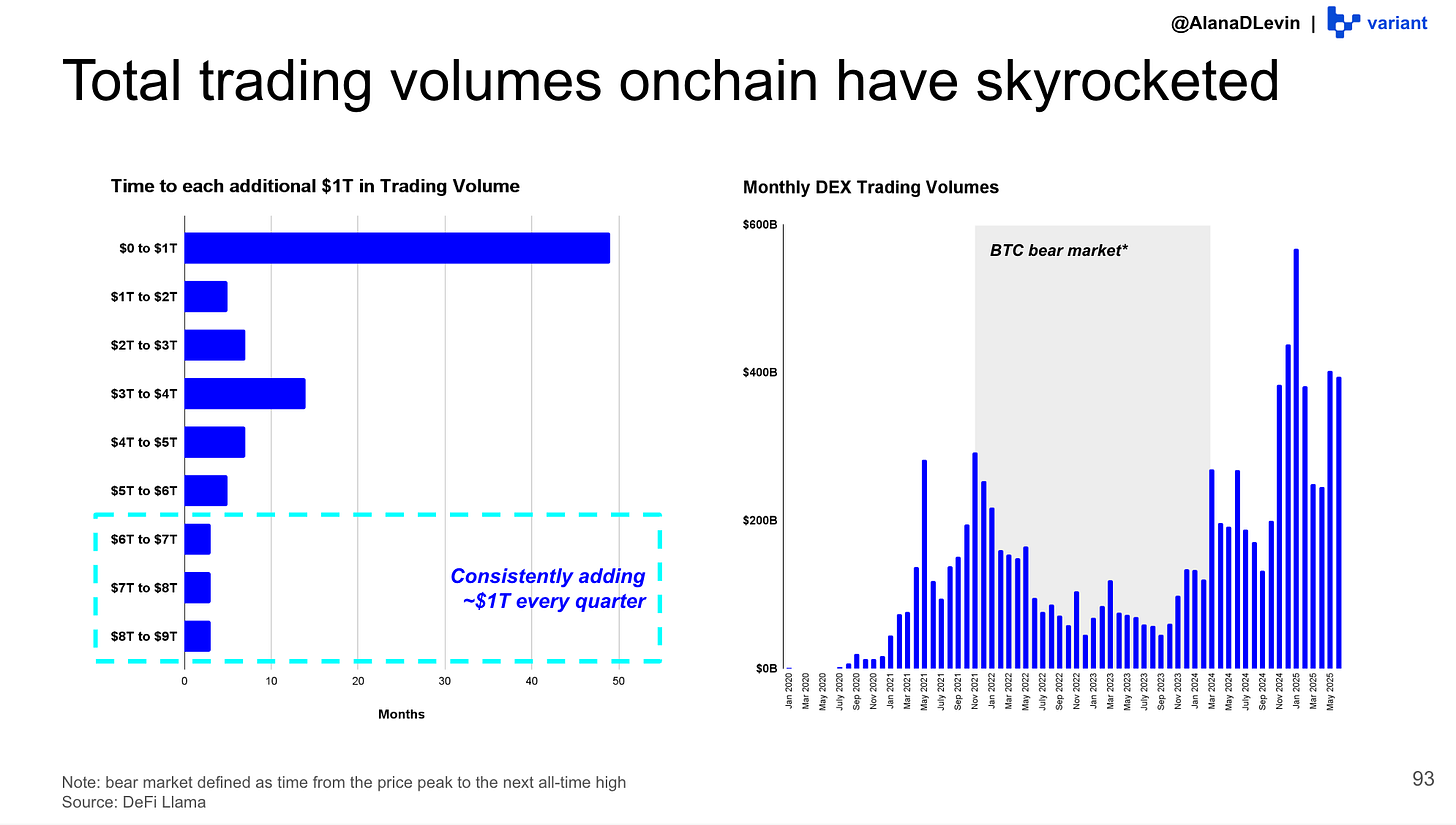

4. Onchain Activity: Curious about new, novel ways to utilize crypto assets? Then look onchain. It’s a hotbed of experimentation. Every element of the asset lifecycle – issuance, liquidity provision, exchange, listing, and productization – is permissionless and open on blockchain rails, whereas every one of these steps is gatekept in traditional finance. Such a setup dramatically expands the design space for creation and utilization. Furthermore, several categories of onchain protocols have begun to mature into solid businesses with strong fundamentals. Decentralized exchanges, lending platforms, token launchpads, and perps exchanges all have exciting signs of product market fit.

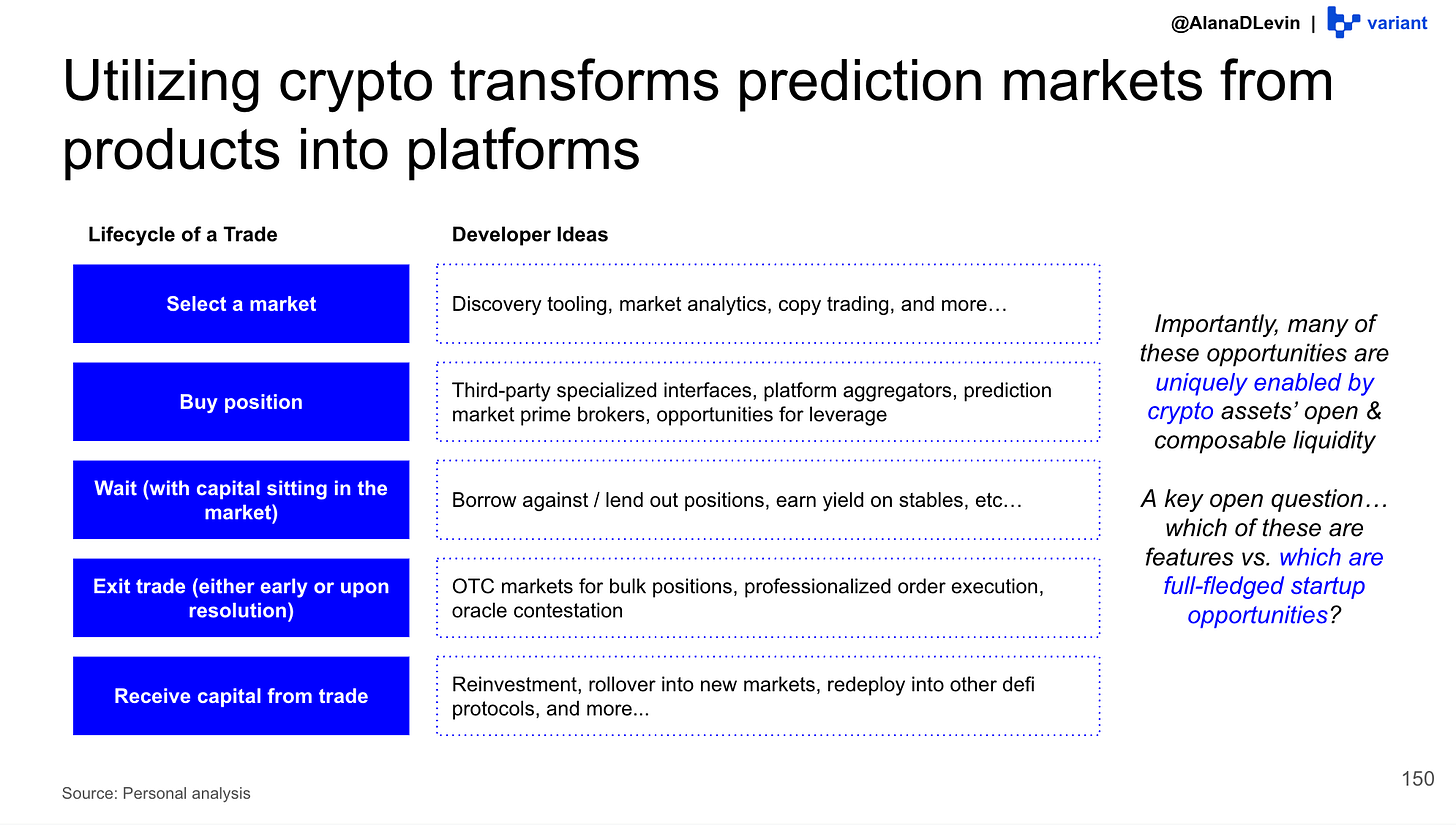

5. What’s Next: Building on crypto rails can transform products into platforms. This section uses the growth in prediction markets as a prime example of a new market that’s supercharged by crypto rails. It also summarizes a (non-exhaustive!) selection of the startup opportunities we’re looking for at Variant.

Enjoy!

Find the full Crypto Trends Report here: https://docsend.com/v/sfvqr/cryptotrends

Fascinating writeup as always Alana.

If asset creation and accumulation are now compounding, the next bottleneck is coordination: how these assets interact across fragmented execution environments. Utilization needs a neutral, programmable layer for cross-chain settlement. Feels like one of the biggest open design spaces heading into 2026.

We are on it ;)

Working on a crypto insurance product and ours will be papered with a government backstop in place!