Public Goods in Crypto

The concept of public goods in crypto is pretty popular. It’s discussed a lot with regard to layer-1s, protocol treasuries, and ecosystem growth. The term has also begun to pop up in investment announcements.

I find this last part especially interesting — prior to seeing firms “invest in public goods,” I had never really thought of public goods as an asset class. To be honest, I still don’t.

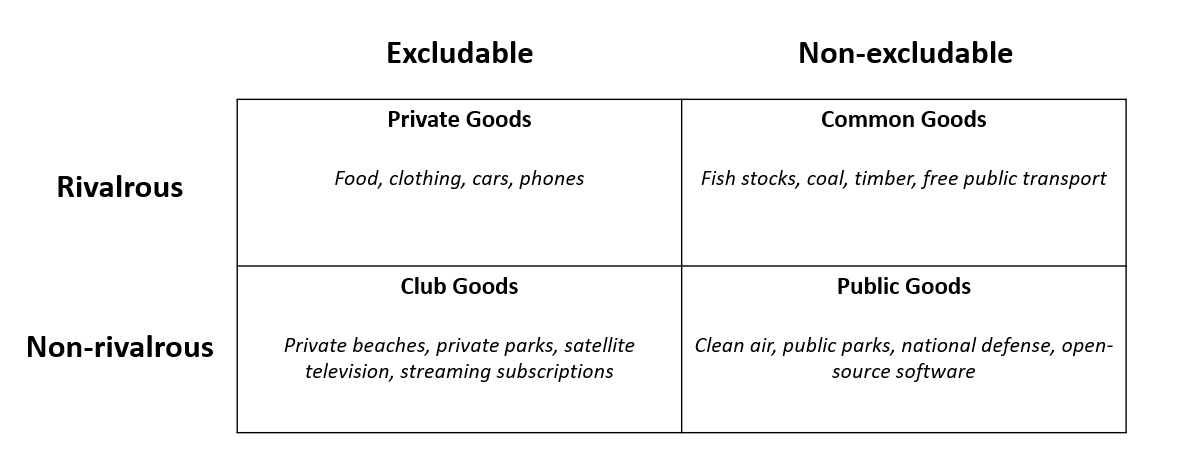

It’s worth taking a step back and thinking about what actually constitutes a public good. Outside of crypto, public goods might include national defense, clean air, and public parks. They’re non-rivalrous and non-excludable. Within crypto, public goods might include layer-1 security, wallets, and open information/data.

Because public goods are non-rivalarous and non-excludable by definition, it’s hard to extract a fee or generate revenue. Rather, the rivalrous products or services adjacent to public goods often benefit the most. In a city with lots of public goods, the value of those goods accrues to things like land. Similarly, a parking garage next to a popular park might experience a lot of traffic as people try to access that good. The products or services that provide access to the public good are typically a point of value capture.

What do those access points look like in crypto? For layer-1 security, the answer might be blockspace. Blockspace is non-excludable but rivalrous, so the more demand there is for its service (access to the protocol’s public good), the higher the fee. For data (such as stored on Arweave), the majority of the value may actually accrue to the indexers and queriers who help access the stored data. Setting up shop at an access point can be good business.

What I still don’t understand, though, is how public goods themselves accrue value. I think there’s merit in the argument that public goods should levy a tax on those rivalrous adjacent services in order to continue funding the public good. I also think there’s merit in the notion that those who invest in the adjacent products or services should simultaneously help sustain public goods (likely in order to continue driving value to their investments). But investments solely in public goods — with the hope of a financial return — don’t make much sense to me.

Why does this matter?

For one, understanding what actually constitutes a public good helps us better allocate resources. Public goods in crypto are some of the most innovative, exciting, and meaningful new developments created in the last decade. We should encourage people to build access points to those public goods. That the term “public goods” gets thrown around so loosely distracts from this goal.

Second, when resources are allocated to “public goods” funding, I think it’s important to specify the public good. Often, that good already exists and might not need much funding. Instead, funding could be dedicated to commoditizing the access points. (The way to drive value to a business is to monopolize those access points; the way to drive value to the community is to commoditize those access points). Funding could be earmarked for rewarding those who volunteer their time to help govern the public good (e.g., DAO delegates). It could be used to drive ecosystem growth or increase awareness of the existence of the public good.

Finally, crypto is in part about creating and relying on strong consensus mechanisms. That requires a shared understanding of what we’re actually talking about. I think one of the reasons people new to crypto find it confusing or frustrating is because of all the new terms created and the misuse of existing, well-known terms. That confusion may deter a lot of people who can help push the space forward — students, academics, developers, builders, etc. Crypto should be easier to understand. Clarity around what’s actually a public good in crypto — including why they’re valuable, how to sustain them, and how to increase access — is an easy first step in the right direction.