Running the Math on Micropayments

It’s time to try micropayments again.

“Again” rightly implies that micropayments have already been tried (and failed). In particular, the idea of using micropayments for accessing content on the internet is a time-worn idea.

In my view, there are two sets of guiding questions one must answer in determining if now is any different:

Is there some disruption in the market that did not previously exist? This could be a change in cost structures, the emergence of a new category of buyers, novel distribution methods, or something else.

Is the idea actually good? There must be a path to making the idea into a big business. Otherwise, it’s (probably) prone to failure every time.

I think the answer to both of those for micropayments is yes, maybe.

On disruption

AI is disrupting the status quo. My guess is that the percentage of paywalled content will increase over the coming years, as sites try to protect their content from becoming uncompensated training data. Moreover, AI agents are new buyers on the internet. It’s easier for them to open a crypto wallet than a bank account. Crypto rails are also sufficiently mature and inexpensive, with transactions (on some chains, like Solana) under a cent. At face value, the micropayments business model looks more attractive – in terms of both cost structure and set of potential customers – than ever before.

On whether the idea is actually good

This one is tbd. I like the idea of micropayments for written content – specifically, paying something like $0.25 to read an article on-demand – because it’s an area where I could personally see myself spending both more time and money. Furthermore, the trend towards subscriptions feels out of control. Almost anytime I discover a news article online, I’m redirected to the subscription purchasing page. It’s become a major pain point.

A pain point combined with a clear willingness to pay (for discrete pieces of content) screams business opportunity. The question is, business opportunity for whom? Startup or incumbent? A good way to conduct the thought experiment is to run some back-of-the-envelope calculations.

Would micropayments make sense for, say, the New York Times?

Let’s take the New York Times, one of the largest public media organizations. The bulk of their revenue currently comes from content subscriptions. At what volumes and viewership would micropayments start to make sense?

In the most recent quarter, the NYT generated almost $600m of revenue. $418m of that came from subscriptions, $117m came from advertising, and the remainder was categorized as “other.” Of subscriptions, digital only-subscriptions comprised 67% ($282M) while print accounted for 33% ($136M). The internet-native subscription category is what seems most relevant to a micropayments comparison.

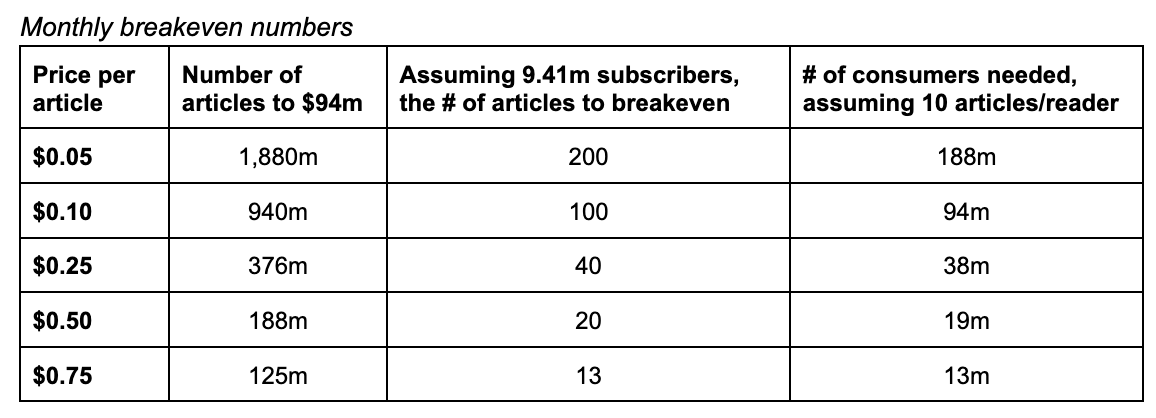

The NYT’s most recent 10Q estimates that they had 9.41m digital-only subscribers. To get to $282m in quarterly revenue ($94m monthly), each subscriber would be paying ~$30/quarter (or an average of $10/month). That feels accurate based on the pricing I’ve seen offered on their website.

Now that we have a baseline value per subscriber, the question becomes: at what volumes would micropayments break even?

In a vacuum, these numbers look challenging. Benchmarking on the $0.25 price point, 38m readers would be a quadrupling of the current subscriber base. Not impossible, but not easy. And it’s possible the average “10 articles per reader” is generous.

SimilarWeb estimates that the NYT website gets ~610m visits monthly. At the $0.25 price point, those visits would need to convert at a ~60% clickthrough rate to break even with the current subscriber revenue. Again: not impossible, but not easy.

There is an argument to be made that micropayment paywalls could increase total viewership. For example, I rarely visit certain paywalled news organizations’ websites because I know I’m unwilling to purchase their subscriptions – but, those websites might be more top-of-mind if I knew there was an alternative path to access.

Framing subscriptions and micropayments as mutually exclusive is a useful thought exercise, but admittedly feels like a false choice. 100% cannibalization is unlikely. The real question is the trade-off between some cannibalization vs. the expected revenue from newcomers enticed by the discrete payments. 10% cannibalization would be $9.4m of monthly revenue lost. At $0.25 per article, the NYT would need to bring in 38m new clicks. The higher the expected cannibalization, the tougher the math.

That the micropayments math isn’t a slam dunk for the New York Times is perfectly ok.

This is what creates space for startups. Structural challenges for incumbents have time and again opened new opportunities. My favorite example is Dollar Shave Club vs. Gillette – Gillette couldn’t fast-follow the DTC strategy because it meant risking their relationships with retailers (their primary sales channel). That gave Dollar Shave Club room to run with the DTC strategy. A few million in revenue from a new category is meaningful for a startup but may look risky to an incumbent. The lack of “product line overhang” is part of what frees startups to go after small but fast-growing markets.

Subscribers and micropayments feel like a similar type of scenario. Startups aren’t burdened by an existing subscriber base. Moreover, a new startup can go after both the whitespace audience as well as incumbents’ existing subscriber bases. One incumbent’s churn is a startup’s opportunity. And one hundred million people spending $1/month on content is still $100m in revenue.

Of course, that begs the question: in what arenas can a startup find an audience of 100m monthly viewers? The new audiences/markets opened up by micropayments and the characteristics of categories ripe for disruption will be the subject of my next piece.

1. For more on the Dollar Shave Club story, I recommend the book Billion Dollar Brand Club

I have a hard time believing that micropayments will work in media.

It is harder than selling ads, and the output wouldn't be different because the incentives are roughly equal. "Is this headline worth my time?" and "Is this headline worth my $0.05?" are very similar propositions.

Instead, what would be great is making long term subscriptions more convenient. Writers would be able to do research, thinking hard about what they write, and spending time editing. They can invest their time and money because their funding is much more reliable. Quality cannot flourish when all that matters is page views. It demands a stable ground.

I think the problem with micropayments is that they're doubling down on a losing proposition. The technical aspects are more or less understood. Even intermediaries can be cut down from the process.

People simply don't want to read something cheap. They only want what is free or expensive.