The Real Alt Season is in Crypto Equities

There have been a lot of questions as to whether we’ll have an alt season in crypto this cycle. Some look at Jan 2024 or 2025 as the peak, where non-Bitcoin cryptoassets appreciated significantly – with many reaching new all-time highs.

In past cycles, major appreciation in the price of Bitcoin has preceded similar appreciation (if not outperformance) of many longer-tail cryptoassets. But over the past few years, we haven’t seen this pattern play out. Bitcoin dominance currently sits at 58% and has been in a steady uptrend since November 2022.

So, is this cycle going to skip alt season? Is it just that alt season isn’t here yet? Or maybe… is alt season already happening in a different market entirely, and just no one is looking?

My sense is that it’s the latter. The real alt season is happening in crypto equities.

What are the characteristics of an alt season setup?

Price appreciation attracts new capital → question is, where is that new capital coming from?

Price appreciation leads to a rotation of profits → question is, who’s taking profits and where is it being redeployed?

There’s certainly new capital looking to get exposure to crypto. But much of this is institutional, not retail. Retail tends to be fast adopters, while institutions are slower and often wait for external legitimization. Well, that’s happening now. The SEC approved the Bitcoin and Ethereum spot ETFs in 2024. Chairman Atkin recently announced Project Crypto. Nasdaq CEO Adena Friedman has advocated for the tokenization of equities. The list goes on.

The institutions are here with fresh capital. My guess is that most of that capital is being directed to crypto equities rather than crypto assets. Equities are familiar and accessible. Institutions already have operational setups (custody, compliance processes, dealer relationships, and more) are already in place, whereas purchasing crypto assets may require brand new capabilities. And buying equities falls within their mandates – vs. direct crypto tokens (much less long-tail alts) may simply be out of scope.

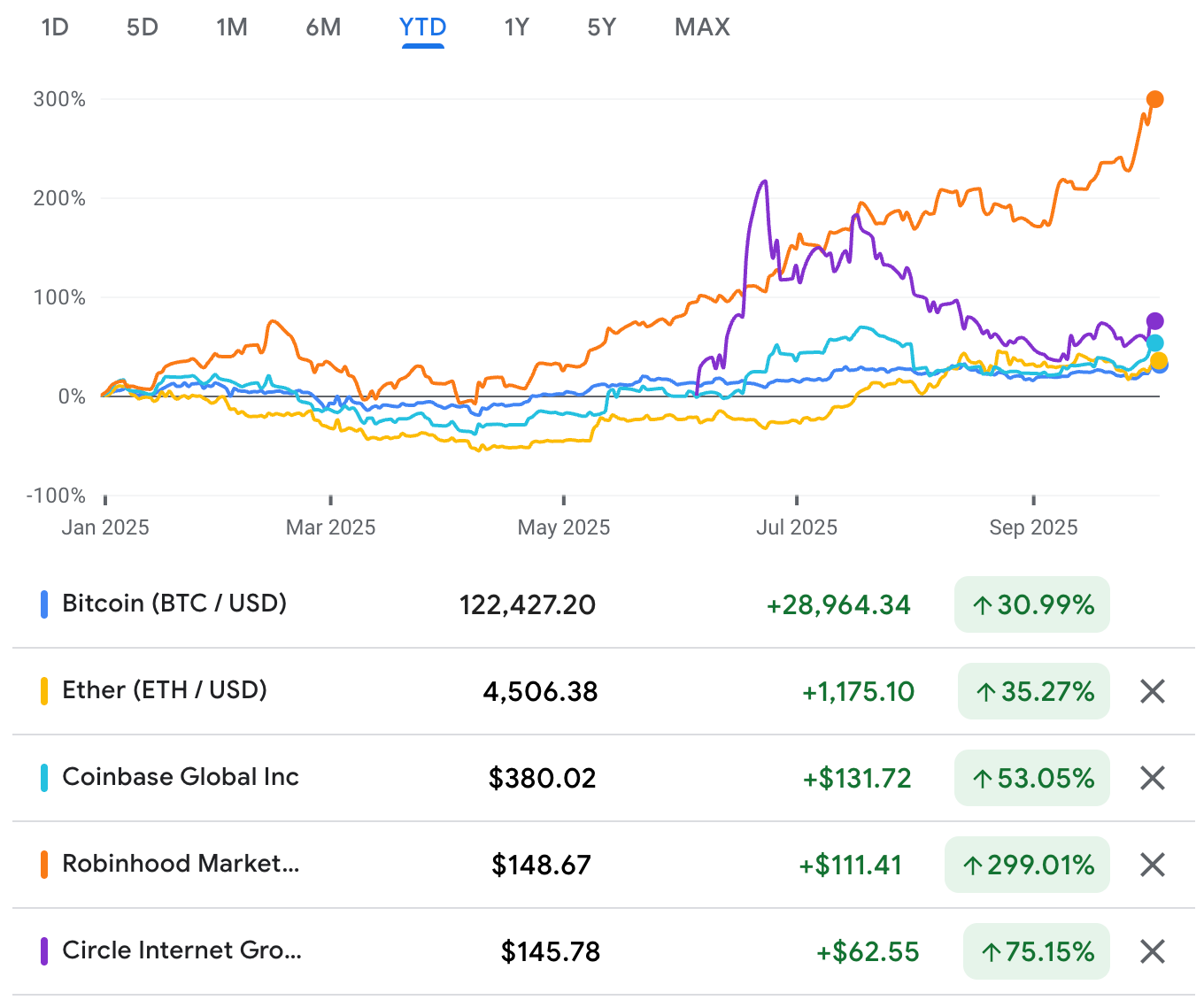

As a result, institutions are plowing money into crypto (or crypto-adjacent) equities. Coinbase is up 53% YTD. Robinhood is up 299%. Galaxy is up 100%. Circle is up 368% since its IPO in June (75% if you use the end-of-day close on its first trading day). Compare that to Bitcoin (up 31%), Ethereum (35%), or Solana (21%) and crypto equities’ outperformance becomes clear.

A similar story holds true if we look at performance since Bitcoin’s bottom on 12/17/22:

There’s good reason to believe this trend will continue. We have a slew of crypto equity IPOs on deck, with many more later stage companies likely to file in the years ahead.

Like a typical alt season, not every asset will perform well. And I expect there to be some rotation, as traders take profits from one expensively priced asset (e.g. CRCL trading at 26x P/S) and redeploy that capital into other assets.

In crypto, we often get different metas: the market might move from DeFi assets to gaming tokens to AI coins. Equities are likely no different. An alt season within crypto equities might see rotation from stablecoin stocks to exchange stocks to digital asset treasuries (or another trend).

There are a number of other reasons I believe that the crypto equities alt season may end up looking more like a historical alt season than any future alt season we get in cryptonative markets:

Asset concentration. There are only a handful of equities that provide exposure to crypto. This is similar to how, in past crypto cycles, there were arguably under 100 tokens that buyers found attractive. And notably, it’s a very different dynamic than the crypto-native market today – which has millions of tokens and, as a result, is experiencing broader dispersion among deployment.

Access to leverage. Last cycle, a number of crypto-native lending desks collapsed. We haven’t seen many rebuild. Equity allocators do have access to leverage, though, which means the booms can get bigger (and the busts can really bust).

We probably will have another alt season in crypto-native assets. But it will take time as the new marginal sources of capital gradually set up operational capabilities that enable them to deploy into cryptoassets.

So for now, it may not be the alt season many expected – but we are in an alt season nonetheless.

Thank you to Hootie Rashidifard and Mason Nystrom for feedback on this essay.