What are Central Bank Digital Currencies (CBDCs)?

The goal of this article is to provide an introduction to CBDCs: what they are, how they could offer new policy tools, and what we’ve seen so far in terms of countries’ progress on CBDCs.

But first, it’s worth noting that CBDCs are not necessarily cryptocurrencies. If a CBDC is built on the blockchain — i.e. a public ledger of all transaction history associated with a specific currency — then it would likely be considered a cryptocurrency. However, if a CBDC is built simply as a “digital dollar,” then it may not technically fall into the “crypto” classification.

Given that CBDCs are a common topic within the broader crypto media discussions — and are often described as a way in which governments could hedge against the growing legitimacy of cryptos like Bitcoin or Ether — CBDCs seem like a relevant and worthwhile term to cover in a crypto newsletter.

So, with that being said, let’s get into it.

What even are CBDCs?

Central bank digital currencies (commonly abbreviated as “CBDCs”) are digital currencies that are backed by reserves in and controlled by governments’ central banks. You can essentially think of them as “digital dollars,” but with much more functionality and interoperability than physical cash.

Notably, CBDCs have been in the news quite a bit lately - the U.S. House Financial Services Committee held a hearing on “The Promises and Perils of Central Bank Digital Currencies” in late July, China’s CBDC (the e-CNY) trial has already conducted over $5.3 billion worth of transactions, and Venezuela is set to launch their own digital currency in October.

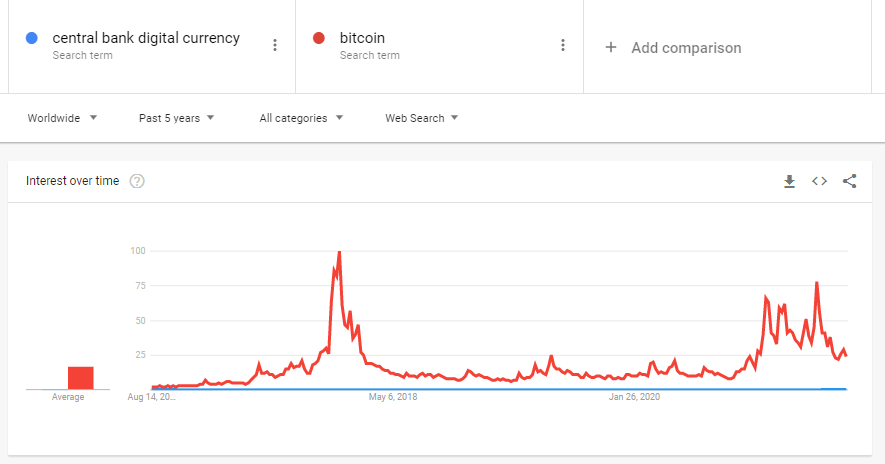

Google searches for the term have also steadily increased over the past five years…

…but still pale relative to searches for more mainstream crypto topics, like bitcoin:

I think that, over time, we’ll see these search term trends change, especially as governments figure out how to deploy CBDCs. I say “as governments figure it out” because there’s still plenty of questions about implementation, including:

How much of the money supply would be shifted to digital dollars?

What happens to the existing cash floating around in the economy?

How do you onboard people and merchants to the system?

What happens to people who don’t have access to mobile/digital devices?

And maybe the biggest question: which branch of the government (at least in the US) has the authority to issue a CBDC? It’s not exactly like the Founding Fathers had digital currencies in mind when crafting the Constitution.

However, if governments can figure out implementation, the benefits of a CBDC could be significant.

How CBDCs could offer new policy tools

There are many ways that CBDCs could offer governments greater levers for policy implementation. Below, I explain five policy tools that I think are particularly interesting:

Policy Tool #1: Stimulus airdrops

When it comes to digital currencies, airdropping is the act of mass-sending instantaneously settled, spendable currency to a set of recepients. During the COVID-19 pandemic, sending physical stimulus checks was error-prone and time-intensive. If the government had been able to just airdrop the money to citizens using CBDCs, this massive task would have been much simpler. CBDCs would allow the government deposit government checks into people’s wallets (it would just be digital coins being deposited into digital wallets). Application processing would be more organized, the deposits could occur instantaneously once approved, and the government could better track who had received a check. Theoretically, they would even be able to track what citizens spent the stimulus on (rent, food, entertainment, etc.) — as each CBDC could have a unique digital identity — and assess the policy’s effectiveness.

Policy Tool #2: More accurate, real-time inflation data

Inflation has also been in the headlines recently — is it transitory or here to stay? Is the government’s price data accurate, or are there lags that haven’t been captured yet?

CBDCs could fix this. Every transaction using CBDCs could feed the prices of goods to a federal database in real-time, providing a more accurate measure of inflation. It’d also be easier to weight, adjust, and update the basket of goods.

Policy Tool #3: Expiration dates

This is a bit of an odd one, but it’s been hinted at with regard to China’s e-CNY.

The main idea here is that the government could incentivize spending by setting expiration dates on cash. In other words, imagine that you open your wallet one day and see that, in a month, $100 worth of money will no longer be valid tender. What do you do? Most people would go out and spend that money before it expires.

This would most likely be paired with some sort of government-sent stimulus (see policy tool #1). It’d be invasive, and quite frankly somewhat scary, if the government could suddenly set an expiration date on your life’s savings. But imagine this type of mechanism attached to a stimulus check (a policy tool intended to support consumption during economic recessions). Expiration dates would help ensure that the money that’s meant to be spent actually gets spent.

Policy Tool #4: Interest rates

Conducting transactions digitally and on the blockchain provides real-time data on prices and liquidity. This is especially powerful for lending.

We’re already starting to see lending protocols emerge within DeFi applications (both Compound and Aave come to mind). These markets price rates dynamically, based on the supply and demand of each crypto within the market. Compare this to the Secure Overnight Financing Rate (SOFR), one of the major interest rate benchmarks within the traditional financial world. The SOFR is set by taking overnight treasury data on repo rates and published daily at 8 am. That means each day’s rate — used by banks globally to conduct trillions of dollars worth of transactions — is using day-old data. CBDC-based rate-setting and lending could offer a much more efficient and accurate pricing mechanism.

Policy Tool #5: Elections and voting

In recent years, there’s been an especially large push to “get out the vote.” Yet some of the biggest barriers to getting more people to vote include difficulty the time it takes to vote (lines can be long and voting centers may be out of the way), language barriers, and just plain indifference toward actually voting.

Imagine if we could incentivize people to vote by offering them digital tokens. Each would have a unique signature (likely tied to a person’s social security number), ensuring one vote per person. Voting could happen digitally, which would eliminate lines and the inconvenience of traveling to a voting station. Because the voting interface would be digital, it’d be easy to integrate language/translation features. Finally, after casting a vote, each token could theoretically be redeemed for some sum of money.

Progress of CBDCs Around the World

While there’s been a substantial amount of CBDC development around the world, most countries are still in the “research” phase. Only ~5 countries have fully launched CBDCs, with the Bahama’s Sand Dollar being the most prominent.

About ten countries have introduced pilot CBDC programs. Most notable is probably China’s e-CNY (which some outlets report China hopes to have fully operational by the 2022 Beijing Winter Olympics), while others include Sweden’s e-Krona, Uruguay’s e-Peso, and Ukraine’s e-Hryvnia.

There are also some joint development projects. Thailand, China, and the UAE have paired up to create the m-CBDC bridge (short for “multiple central bank digital currency bridge”) as a mechanism to facilitate better cross-border transactions. The European Central Bank is also working on a Digital Euro with the goal of “maintaining the autonomy of domestic payment systems and the international use of a currency in a digital world.”

It’s worth noting that many of these projects have (at least) 3-5 year time horizons. Full launch is likely even further away — it takes time to figure out the proper infrastructure, determine what portion of the money supply should be digital, update existing financial systems, and inform/convince people about how and why to adopt a CBDC.

Final Thoughts

At the end of the day, crypto isn’t going away. I think we’re going to see the development of CBDCs grow rapidly as other parts of crypto grow and gain legitimacy. The main question is whether it can be done before a decentralized currency really begins to dominate the global financial system. Innovation almost always outpaces regulation, and trying to innovate and regulate simultaneously — such as is necessary with the launch of a CBDC — is hard.

I’m curious to see how this post ages over the next 5-10 years. It’s possible that by that time we’ll all be using CBDCs. It’s also possible that CBDCs won’t be a thing — governments may shun adoption, Bitcoin and Ether may be the preferred reserve and transactive currencies, or some third alternative. CBDCs of the future may also look vastly different from the versions I outlined today. The architectures are complicated, and I’m sure there are dozens of new policy tools that will be created as development progresses.

Either way, I look forward to seeing what happens.

Thank you to Nishita, Nathan, Spencer, and Chloe for reading drafts of this article.